News & Updates

We welcome you to review our recent deal announcements as well as our quarterly and annual reports for updates on the latest trends within M&A.

Our team focuses on industry trends and notable market activity, and encourages you to share what you find insightful.

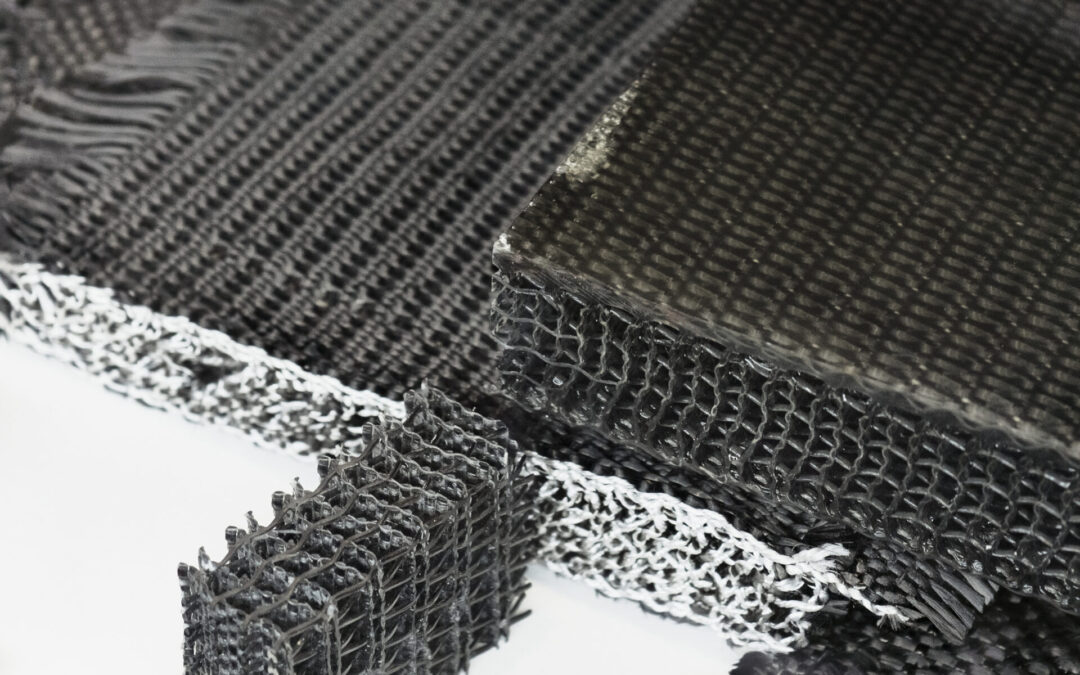

Seemann Composites Acquired by Karman Space & Defense (NYSE: KRMN)

LONG BEACH, Calif.--Karman Space & Defense (“Karman”, “Karman Holdings, Inc.” or “the Company”) (NYSE: KRMN), a leader in the rapid design, development and production of critical,...

Estes Energetics Acquired by Voyager (NYSE: VOYG)

PENROSE, CO–(KAL Capital Markets)–Estes Energetics ("Estes Energetics" or "the Company"), a U.S.-based leader in solid rocket motors, black powder, and critical energetic chemicals for defense and...

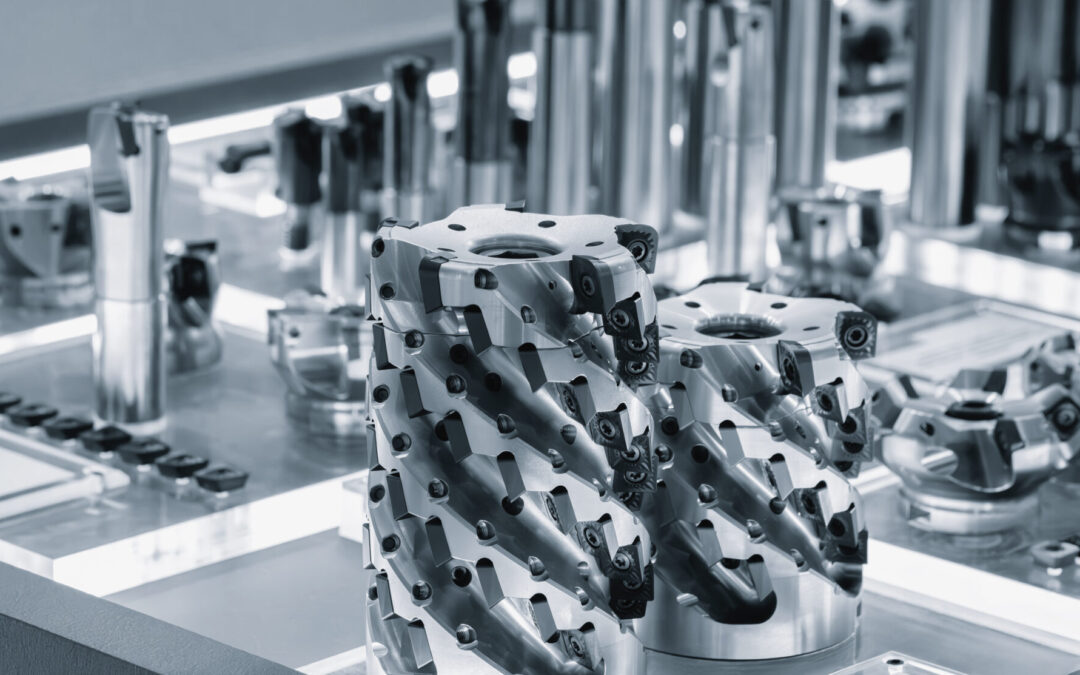

Machine Sciences Acquired by Viking Global

TUALATIN, Ore. (November 18, 2025) — Machine Sciences, a leading aerospace component supplier and precision manufacturer, today announced a strategic investment by Viking Global Investors...

Foresight Finishing Acquired by Valence Surface Technologies

EL SEGUNDO, Calif.--(KAL Capital Markets)--Valence Surface Technologies LLC (“Valence”), the largest independent aerospace surface finishing platform in North America, today announced the...

Five Axis Industries Acquired by Karman Space & Defense

HUNTINGTON BEACH, Calif.--(KAL Capital Markets)--Karman Space & Defense (“Karman”, “Karman Holdings, Inc.” or “the Company”) (NYSE: KRMN), a leader in the rapid design, development and...

Jamco, Bain Capital Acquire Aerospace Technologies Group

LOS ANGELES, CA - September 3, 2025 - Jamco Corporation, a Bain Capital portfolio company and Japan’s leading manufacturer of cabin interior equipment for the commercial aviation industry, and Bain...

Cogenuity Acquires Interconnect Solutions Company From Tide Rock

LOS ANGELES, CA – September 3, 2025 – Cogenuity Partners (“Cogenuity”), a lower middle market private equity firm investing in critical businesses within the advanced industrial economy, today...

Arcline’s IPS Acquires Oldham Seals Group

LONG BEACH, CA, June 27, 2025 /KALCapital/ -- Integrated Polymer Solutions, Inc. ("IPS"), a portfolio company of Arcline Investment Management ("Arcline"), today announced the acquisition of Oldham...

The Rise of Specialized Metal Processing Firms in Aerospace M&A

3P Processing’s Acquisition by Littlejohn Capital Finding the right strategic growth opportunity in the fast-moving aerospace and defense M&A landscape can feel like searching for a needle in a...

Metal Technology, Inc. (“MTI”), Leading Supplier of Refractory Alloy Systems, Acquired by Karman Space & Defense

KAL Capital Markets Represents 16th Tight-Tolerance, High-Precision Manufacturing Business in the Aerospace and Defense Market. Long Beach, Calif.-April 4th, 2025-(KAL CAPITAL)--Karman Holdings...

KAL Capital Advises Spira Manufacturing

Spira Press Release Long Beach, CA, January 16, 2025 - Spira Manufacturing Corporation was acquired by Integrated Polymer Solutions (IPS), a portfolio company of Arcline...

KAL Capital Advises ACT Aerospace Transaction

NEW YORK, Feb. 3, 2025 /KAL Capital/ -- The Thermal Group ("TTG" or the "Company"), a leading designer and manufacturer of mission-critical and highly engineered components for the...

Aerospace and Defense Review for Q4 2025

Download PDF Here. Dear Friends, As we close the books on 2025 and enter the new year, Q4 reinforced what many inthe market have been feeling for the past several quarters: Aerospace, Defense, andSpace are operating from a position of strength. Public market sentiment...

Aerospace and Defense Review for Q3 2025

Download PDF Here Dear Friends, We Hope you're enjoying the fall as we enter the final stretch of 2025. The third quarter brought real dislocation across Washington and industry. As of this writing, the federal government remains shut down - a stark reminder of the...

Aerospace and Defense Review for Q2 2025

Download PDF Here. Dear Friends, We hope you're enjoying the summer and finding time to recharge as we enter the second half of 2025. The first half of the year was among the most active in KAL Capital's history. We closed seven transactions across the aerospace and...

2024 EOY Newsletter

Download Full Report Here Dear Friends, Happy New Year! For KAL Capital, we reflect back on 2024 and will remember it (mostly) fondly. Forthe firm, we continued to grow from both a transaction activity and personnelperspective. For the year we completed eight M&A...

Q3 2024 Quarterly Report

Download Report Here Dear Friends, We hope you’re doing well as we enter the final quarter of 2024. The Aerospace & Defense industry has experienced several significant developments over the past few months, and we’re excited to share some key highlights. The...

Q4 2023 Quarterly Report

Download Report Here Dear Friends, As we enter a new year, we have spent the last several weeks reflecting on 2023both from a KAL Capital and market perspective. For KAL, the year was filled with a few notable milestones. Amazingly, we closed our50th transaction which...

KAL Capital Q3 Newsletter

Click here for the Newsletter Dear Friends, We had an extremely busy quarter at KAL Capital both in terms of transaction activity as well as changes at the firm. On the transaction front, we were pleased to announce three transactions:Hypergiant a provider of...

KAL Capital FY23 Q2 Newsletter

KAL Capital FY23 Q2 Newsletter Dear Friends, Happy 4th of July! We are encouraged by recent developments in both the A&D industry as well as the broader M&A market. For aerospace, we spent several days busily catching-up in-person with financial sponsors and...

KAL Capital Q1 2023 Newsletter

Click here to view the full newsletter. Dear Friends, We are pleased to have turned the corner on what was a difficult winter both in terms of the rainy Southern California weather as well as the environment for M&A. Entering Spring, we have seen the environment...

FY2022 Newsletter

Click Here to View Newsletter Dear Friends, For many, 2022 represented a year of challenges as inflation and rising interest rates caused significant disruption that was reflected in declining public equity valuations, choppy credit markets and ultimately reduced...

KAL Capital Q3 2022 Newsletter

View Newsletter Here Dear Friends, We hope that everyone enjoyed a great Thanksgiving with their families. Apologies for the delay with our Quarterly Industry Review, but we have been quite busy with both closed transactions as well as gearing up for several new...

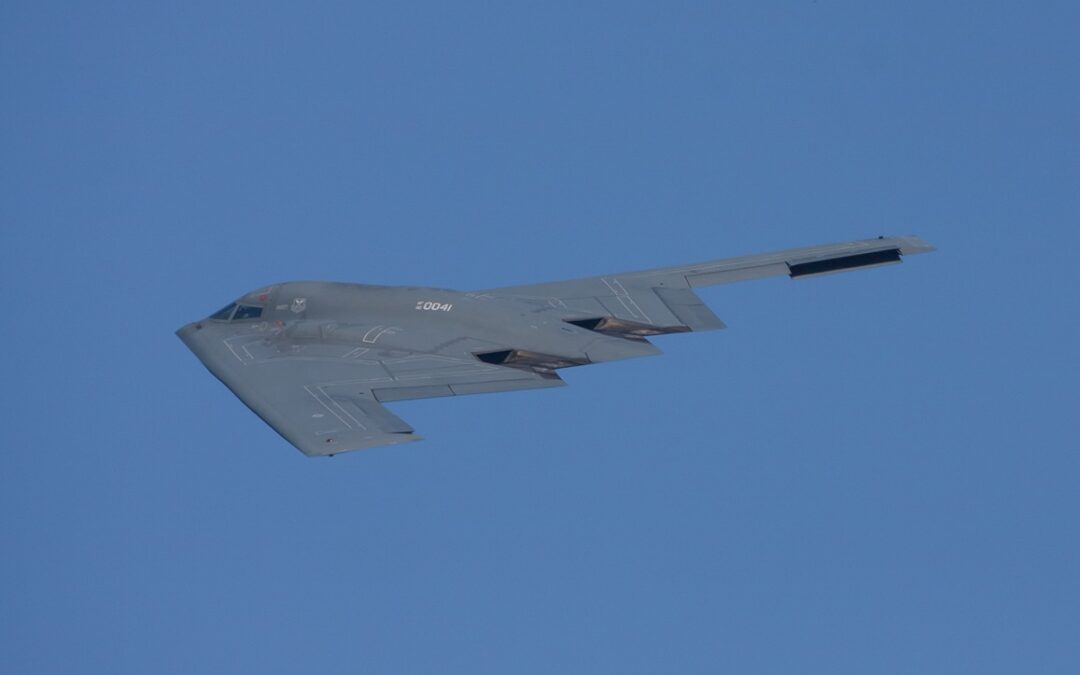

The ‘Golden Dome’ Initiative and Its Impact on Aerospace & Defense M&A Trends

The "Golden Dome" missile defense project, announced by President Donald Trump in May 2025, is set to reshape the aerospace and defense (A&D) mergers and acquisitions (M&A) landscape. With an initial $25 billion budget and projected costs of $542 billion over...

How U.S. Defense Spending Is Changing Under DOGE Reforms

How U.S. Defense Spending Is Changing Under DOGE Reforms U.S. defense spending is undergoing a major transformation under the Department of Government Efficiency (DOGE). Launched in early 2025, DOGE aims to cut federal expenditures while improving military efficiency....

Aerospace and Defense IPOs: Sector Growth & Success | KAL Capital

The Rise of Aerospace and Defense IPOs: A Sign of Sector Growth The aerospace and defense (A&D) sector witnessed a remarkable surge in IPO activity, signaling a strong recovery and growing investor confidence. Notably, StandardAero, Loar Holdings, and Karman led...

The Effect of an Upcoming Trump Administration on M&A

Download full PDF here In the fast-evolving world of Aerospace & Defense Investment Banking, shifting U.S. policies play a crucial role in shaping the M&A landscape. With the potential return of a Trump administration, the A&D sector could see sweeping...

Sector Update – Space Domain Awareness

Market motions, trends, M&A and VC deal flow in and around Space Domain Awareness (SDA)Click here for the report.

Payload Space Investor Summit

KAL is proud to be a sponsor of the 1st annual Payload Space Investor Summit. The event will be on Wednesday, November 8 in Venice, Los Angeles. More details on the event can be found here. Please reach out to a KAL team member if you'd like to schedule time to meet...

Sector Update – Space Technology

Market motions, trends, M&A and VC deal flow in the space technology sector. Please see the report here.

Sector Update – Uncrewed Systems & Autonomy

Market motions, trends, M&A and VC deal flow in uncrewed systems & autonomy sectors. Please find the report here.

Hypergiant Acquired by Trive Capital

Trive Capital, a Dallas-based private equity firm, announces the acquisition of AI defense platform and solutions company Hypergiant Industries, to complement its current portfolio company Forward Slope. The acquisition is a natural partnership for the two...

KAL Capital – Defense Innovation Ecosystem Overview

Defense Innovation Ecosystem Report (PDF) Dear Friends, We are pleased to share with you our team's analysis of active trends shaping the defense innovation ecosystem. The US National Defense Strategy calls for a “broad and deep change in how we produce and...

2023 Aerospace and Defense M&A Outlook

As inflation continues to reduce the value of each dollar and fears of a recession loom, many sectors are already seeing retractions in the mergers and acquisitions marker. In aerospace and defense M&A, things are more complicated. A&D is its own unique world,...

International Microwave Symposium

The KAL Capital team will be attending IMS 2025 in San Francisco. We'd love the opportunity to meet with you at the show and walk through our perspective on the market.Link to the Event

International Paris Air Show

The KAL Capital team will be attending PAS 2025 in Le Bourget. We will be launching several deals, let us know if you are interested in a quick meeting on the show floorLink to the Event