LONG BEACH, Calif.–Karman Space & Defense (“Karman”, “Karman Holdings, Inc.” or “the Company”) (NYSE: KRMN), a leader in the rapid design, development and production of critical, next-generation system solutions that align with the U.S. Department of War’s core mission priorities, today announced its entry into a definitive agreement to acquire Seemann Composites and MSC, leaders in specialty maritime defense technologies. Seemann and MSC’s core technologies for submarines and related amphibious platforms include (i) sonar, acoustic and signal mitigation solutions, (ii) subsea and surface propulsion systems, and (iii) missile and amphibious strategic launch products. The transaction is subject to customary closing conditions and regulatory approvals with Karman providing a total consideration of $220 million, consisting of $210 million in cash and approximately $10 million in Karman common shares.

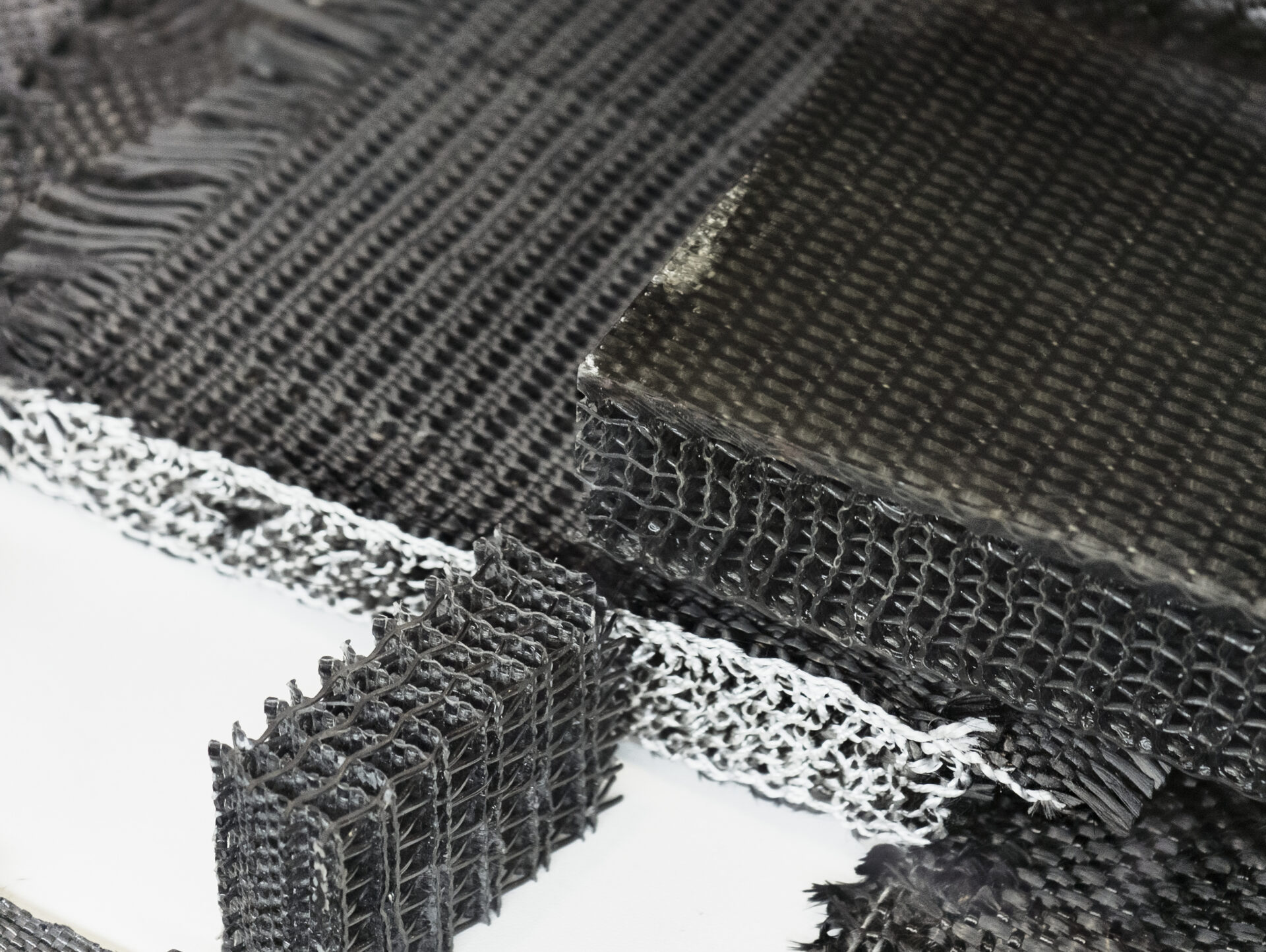

Seemann and MSC, based in Gulfport, Mississippi, and Horsham, Pennsylvania, respectively, have a combined 95 years in business and deliver mission-critical technologies and systems to the U.S. Navy, building on decades of proven performance across multiple high-priority U.S. Department of War (“DOW”) programs. The Seemann/MSC team designs, tests, qualifies and manufactures integrated advanced materials and acoustic coatings, along with propulsion systems, that enhance system-level performance for submarines, surface vessels and autonomous maritime platforms. With the engineering talent, demonstrated performance and scaled manufacturing capabilities required to take a product from concept to production and sustainment, Seemann and MSC strengthen Karman’s vertical integrated platform, particularly in advanced materials, to better serve customers across its end markets.

“Entering the strategic maritime defense market, which is a critical element of near-peer nation state deterrence, has been on our strategic roadmap for years,” said Tony Koblinski, Karman chief executive officer. “The acquisitions of Seemann and MSC represent the natural expansion of the Karman platform into a compelling new market that is poised for decades of sustained growth. With a proven track record of performance, deep expertise in advanced materials, and differentiated manufacturing capabilities, these innovative companies are a natural fit with Karman.”

“We look forward to leveraging the combined strength of the Karman, Seemann and MSC teams to continue delivering advanced technologies to the U.S. Navy and to other customers,” Koblinski added.

“We’ve known and respected the Karman team for nearly a decade, and we are thrilled to start this new chapter of our history as part of Karman,” said Sid Charbonnet, Seemann and MSC chief executive officer. “Seemann and MSC deliver specific capabilities in materials, design, testing and manufacturing, which will further enhance Karman’s impressive product lines and ability to rapidly and effectively address the near-peer nation state threats of today and tomorrow. The alignment of culture and capabilities with Karman provides a perfect fit for our team and will add value to our customers and to Karman’s shareholders.”

Seemann and MSC are pioneers in the advanced composites market, with unique engineering resources, proprietary materials and resin formulations and approximately 240,000 square feet of manufacturing space. These capabilities and capacity enable Seemann and MSC to meet the accelerating, multi-decade demand for new submarines, fleet sustainment and the development of emerging unmanned platforms through multiple programs of record, including Columbia, Virginia and Seawolf class submarines.

“As the second generation of family leadership at Seemann, I am extremely proud of what we have accomplished,” commented Will Seemann, Seemann and MSC chief financial officer. “None of this would have been possible without the strong foundation my father, Bill Seemann, established in 1987. Based on his vision for the company to become a critical supplier to the maritime industrial base, Seemann has built a strong, growing position in this high priority defense sector, which will add value and diversity to the Karman strategy. We are excited to continue our legacy of excellence through innovation as part of the Karman team.”

Karman expects the acquisition to expand Karman’s access to multi-decade, high priority, funded U.S. Navy programs and to be immediately accretive in 2026 to revenue growth, funded backlog, EBITDA, earnings per share and cash flow. Karman further anticipates the acquisition will maintain its position at the upper echelon of Adjusted EBITDA margins among defense technology companies. Concurrent with this transaction, management affirms its prior fiscal year 2025 revenue and adjusted EBITDA guidance issued on November 6, 2025.

Upon completion of the transaction, key members of the Seemann and MSC executive management teams will remain in leadership positions. The transaction is expected to close during the first quarter of Karman’s fiscal year 2026, subject to customary closing conditions and regulatory approvals. At close, Seemann and MSC will operate as wholly owned subsidiaries of Karman.